April’s smaller-than-expected gain cane be traced back to a 0.2% dip in the price of food following February’s outsized gain of 3.9%. The rise in energy prices slowed from February’s 3.3% to a still uncomfortable 2.6%.

The Federal Reserve, however, remains focused on core inflation, or inflation that excludes food and energy.

The core rate last month edged up 0.3%, suggesting that higher energy and raw material prices may be starting to impact the broader prices level.

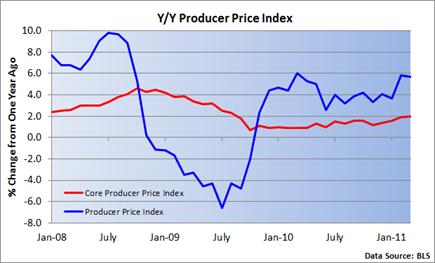

Year-over-year, producer prices, though still at heightened levels, did ease from 5.8% to 5.7%, but the core rate continued to creep higher, rising from 1.9% to 2.0%.

About the only piece of relatively good news is that the increase in prices at the earlier stages of production are relatively stable (see chart above and below).

Most members of the Fed have argued that the jump in commodity prices will have only a transitory effect on inflation, and a continued moderation in increases may bolster their case.

That may be the case, even as the Fed's aggressive policy has helped to feed commodity inflation.

Still, I’m a bit skeptical. Though we are not seeing an ever-increasing rate of price increases, prices at this level can be very volatile and pressures have yet to abate. And the Fed's own anecdotal data suggest that businesses are beginning to experience a degree of pricing power.

Nonetheless, it’s important to look at the other side of the equation, and powerful forces remain in place that are helping to keep retail inflation from getting out of hand.

Wages, which are the biggest cost to most businesses, are rising very slowly, and there is still plenty of slack in the economy. Moreover, a ten-year Treasury yield that has been hovering near 3.50% is not signaling an imminent outbreak in inflation.

Tomorrow, we’ll get the latest on consumer prices when the Consumer Price Index is released. A survey by Bloomberg reveals that analysts expect a 0.5% rise in the headline rate and a 0.2% increase in the core rate.

Fed policy remains extremely accommodative, but rising prices at the wholesale level are beginning to complicate matters for policymakers.

0 comments:

Post a Comment