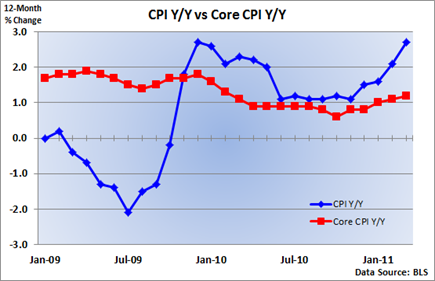

But there was some good news, as core inflation, which eliminates the volatility caused by food and energy prices, was muted – details at Examiner.

After watching the core rate of inflation rise 0.2% in both January and February – the first such back-to-back increases in over a year- it was a relief to see the core rate return to a more subdued rise of just 0.1%.

A drop in apparel prices played a role and shelter, which accounts for almost one-third of the CPI, barely moved and is up just 0.9% from one year ago.

Still, commodity prices have been soaring and the extra slack in the economy that’s helped to rein in pricing pressures is slowly dissipating as the manufacturing sector continues to excel.

Looking ahead, core inflation seems likely to slowly push higher since businesses are beginning to tap into their new-found pricing power, but don’t expect any outsized jumps in prices amid fears they would alienate customers.

Additionally, labor costs, which make up the bulk of expenses for most business, remain contained. In other words, we’re probably OK on the pricing front in the short term.

What concerns me are the obstacles we don’t see that are beyond the horizon, especially since commodity prices are in the stratosphere.

Unlike the last decade when the Fed was gradually raising interest rates against the backdrop of rising raw material prices, monetary policy remains extremely accommodative this time around.

Fed officials have repeatedly said they are willing and able to implement an exit strategy, preventing inflation from heating up. But they are constrained by the current economic environment, which seems likely to prevent anything more than a subtle shift in policy in the near term.

0 comments:

Post a Comment