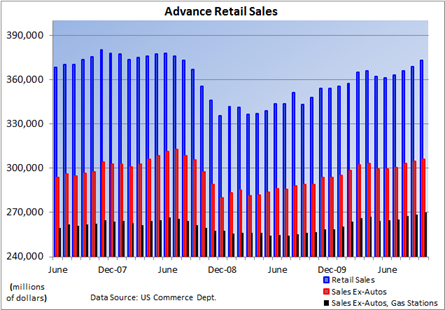

Looking at so-called core sales, which excludes the volatile auto category as well as gasoline station sales – so that the rise in gasoline prices is filtered out, sales still managed to increase 0.4%.

Despite lackluster consumer confidence, retail sales continue to slowly improve, as evidenced by both charts. What may come as a surprise to many is the fact that sales ex-autos and core sales are actually above where they were when the recession began in December 2007.

The inability to surpass the December 2007 level for overall sales, however, reflects the slow recovery in autos.

Still, the rise in core sales is a strong sign that the health and pace of the recovery is improving. Moreover, the rate of improvement has been accelerating (see chart above), which suggests that economic activity is also gradually picking up.

Despite the relatively favorable tone to today’s report, retailers won’t be shelving plans to offer steep discounts during the Christmas shopping season, but recent data suggest that some establishments may be pleasantly surprised, as consumers slowly re-engage during the upcoming and all-important holiday shopping season.

Eventually, and maybe sooner rather than later, a more even recovery should translate into more hiring (see Growth is the cure for high unemployment).

0 comments:

Post a Comment