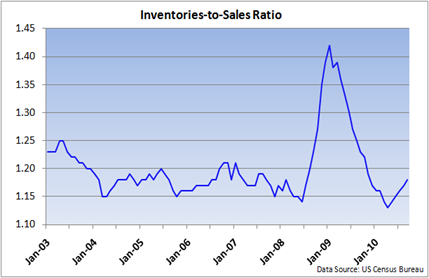

The inventories-to-sales ratio, which measures how long it would take to liquidate stockpiles at the current sales pace, rose from 1.17 months in August to 1.18 in September, continuing the incremental streak of increases that began in April when the ratio stood at a very lean 1.13.

The out-sized gain in inventories at the end of the third quarter stands to benefit GDP, which will find support when next revision to the quarterly number is released later in the month.

But given that inventories remain lean in relation to sales, and the fact that about half the rise in stockpiles came from higher oil and food prices, the upward drift in the inventories-to-sales ratio should not be a cause for alarm.

Furthermore, sales remain in an upward though moderating trend, rising 11.9% from one year ago.

The rise in the ISM Manufacturing Index for October, coupled with strength in key subcomponents, suggests a further acceleration in production in the near term.

0 comments:

Post a Comment