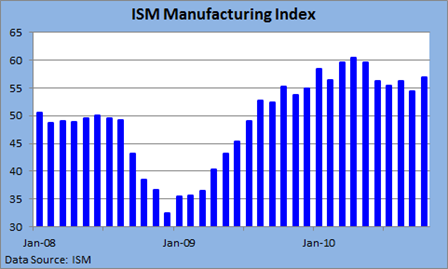

The ISM Manufacturing Index increased from 54.4 in September to 56.9 in October, exceeding estimates. A reading above 50 suggests that manufacturing activity is expanding.

Manufacturing growth has slowed from its heady pace earlier in the year, but the best reading since May shows that the one bright spot in an otherwise dull economic recovery is not dimming. Moreover, key subcomponents suggest further gains in the months to come.

New orders jumped 7.8 points to 58.9, and production grew 6.2 points to 62.7. And survey respondents said they believe customer inventories are still too low, adding to the overall favorable tone.

In the absence of a vigorous recovery at home, an improving world economy has played a big role in lifting the fortunes of U.S. manufacturers.

Recent weakness in the dollar could also help because it aids U.S. competitiveness. However, rising raw material prices could cut into profit margins, as prices paid inched up to an uncomfortable 71.0.

Survey comments, reported by the ISM, included:

- "The dollar is weakening again, which is resulting in higher costs for our materials we purchase overseas. It is hurting our profit margins." (Transportation Equipment)

- "Business slowing down but still double digit over last year." (Chemical Products)

- "Currency continues to wreak havoc with commodity pricing." (Food, Beverage & Tobacco Products)

- "Customers remain cautious, placing orders at the last minute, making supply planning a challenge." (Machinery)

- "Our customer base — auto manufacturers — is expanding capacity and making major capital investments." (Fabricated Metal Products)

0 comments:

Post a Comment