The Federal Reserve, in what had to be the most anticipated shift in monetary policy history, announced four weeks ago that it plans to buy an additional $600 billion in longer-term Treasury bonds.

Known as quantitative easing (QE) , which is defined as purchases of securities over and above what is needed to keep short term rates at zero, the new bond buys are part of the Fed’s own stimulus program that is designed, at least in theory, to boost the economy, create new jobs and prevent deflation from taking hold in the U.S. (was always just a very remote possibility in my view).

The first round of QE – about $1.8 trillion in bond buys – did help to stabilize the financial system in late 2008 and early 2009 when the implosion in credit markets threaten to send the U.S. and global economy into a worldwide depression.

The Fed did help to stave off a crippling depression, but failed to prevent the worst economic contraction in over 70 years, highlighting the limits of monetary policy.

Aversion to risk – the roadblock to recovery

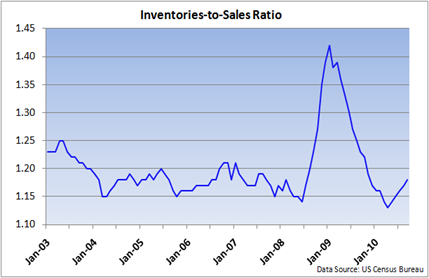

Risking taking all but disappeared two years ago, as banks and just about everyone else sought safety and capital preservation. Hence, as the chart above reveals, excess reserves – defined as cash that is over and above what’s required to be held in the event of emergency customer needs – exploded.

And this aversion to risk among banks and consumers, which has played a major role in hampering the recovery, becomes clear when one sees that banks are holding nearly $1 trillion in excess reserves!

This time around, as the Fed gets set to prime the pump once again, things are a bit different.

Though the world’s largest economy and much of the developed world continue to slowly emerge from the recession, China and other emerging markets (EM) are experiencing robust growth.

With the Fed set to pump $600 billion in newly minted cash into the system - QE2 as it is commonly called, much of the new stimulus seems likely to find its way into the faster-growing economies, further propelling EM growth and risking new asset bubbles around the world.

Additionally, speculation in investments that have performed well in the last year may also be the beneficiary of this newly created cash. Think gold, oil, copper and a host of other raw materials. That in turn is already stoking inflation in commodities.

Consequently, with the huge piles of cash still sitting on the sidelines, it seems very unlikely that new bond buys will have much of a direct and favorable impact on the U.S. economy.

Unless policymakers at the central bank are able to employ an exit strategy at just the right time, inflation could easily extend beyond commodities.