Unlike the Minneapolis Fed President, whose speech earlier in the week took a dim view of new measures, Dudley believes that options still on the table could help to boost inflation and economic growth.

“The pursuit of the highest level of employment consistent with price stability, the current situation is wholly unsatisfactory. Given the outlook that the upturn appears likely to strengthen only gradually, it will likely be several years before employment and inflation return to levels consistent (my emphasis) with the Federal Reserve’s dual mandate.”

He went on to say, “The failure of the recovery to catch fire has occurred despite aggressive monetary (a zero fed funds rate and $1.7 trillion in longer-term asset buys) and fiscal policy steps to stimulate the economy."

Exactly. Despite these purchases, the recovery has been fragile, even hitting a soft patch during the summer.

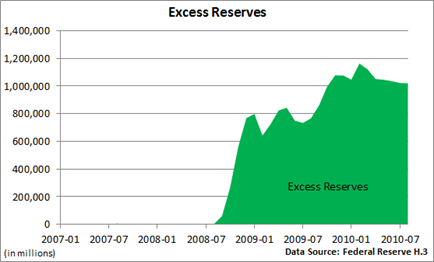

The unconventional tools used by the Fed did help to stabilize the financial system at a time when the credit markets were broken. But despite $1 trillion in excess reserves at the nation’s banks, not much in the way of new lending has materialized.

Moreover, consumers and businesses have been shying away from new debt.

Nonetheless, Dudley said that “$500 billion of purchases would provide about as much stimulus as a reduction in the federal funds rate of between half a point and three quarters of a point.”

At this point, a new round of QE would likely have diminishing returns, in my view.

Why the Fed feels compelled to send more money gushing into the banking system when banks already hold about $1 trillion in excess reserves is puzzling.

If they could force mortgage rates down to 3% or below, cheap financing might encourage fence sitters. But the Fed’s control over long-term rates is limited.

More likely, the dollar could head lower, threatening to create a modest round of import inflation. That doesn’t seem to be the recipe that’s need to get the recovery on track.

0 comments:

Post a Comment