Three key surveys that measure many different aspects of manufacturing and one that looks at service industries, including prices, provide clues as to what may happen down the road.

First, the Philly Fed (mid-Atlantic region) and Empire (New York) surveys, which measure the ups and downs in prices paid for raw materials (red, blue), are detecting pricing pressures at the early stages of production.

However, demand has been sluggish and firms have very little pricing power – another way of saying that they are having trouble raising prices. This is especially evident in the Philly Fed’s survey (purple) of prices received.

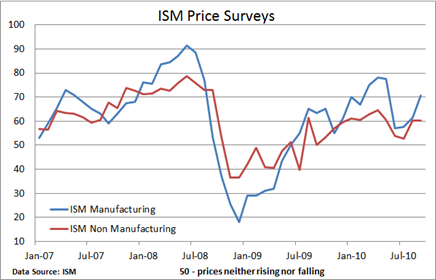

The Institute for Supply Management’s survey looks at both manufacturing and non-manufacturing conditions around the nation.

ISM manufacturing confirms much of what we are seeing in raw material prices, while ISM non-manufacturing reflects more modest pricing pressures. Unlike the Fed indexes, ISM does not offer a prices received subcomponent.

Wholesale prices are rising

Consumer prices continue to languish and the latest CPI shows that core inflation is at a multi-decade low, but the story is a bit different at the wholesale level - chart.

The summer soft patch in the U.S., along with temporary gains in the dollar, did mute price increases just a few months ago. But commodity prices are once again on the rise, which was reflected in much of September’s data, as well as the Empire’s report in October. And the continued rise in many raw materials, coupled with the dollar's weakness, suggests that the upward pressure in prices will likely intensify, at least in the short term.

Consequently, without a new global recession and a contraction in the U.S., it is difficult to see how a general decline in the price level can take hold.

0 comments:

Post a Comment