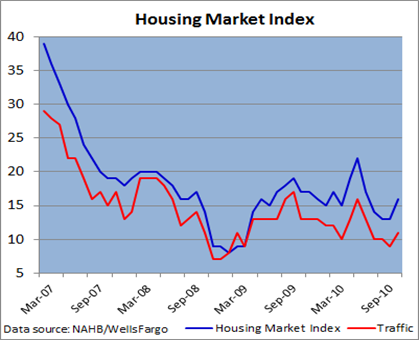

The Housing Market Index improved from 13 in September to 16 in October but remains well below the level of 50, which would indicate builders are neither optimistic or pessimistic. Traffic also picked up, rebounding from an 18 month low of 9 to 11 as increased buyer interest also lifted the mood among builders.

“Builders are starting to see some flickers of interest among potential buyers, and are hopeful that this interest will translate to more sales in the coming months," said NAHB Chairman Bob Jones, a home builder from Bloomfield Hills, Mich.

"However, because most builders still have no access to credit for building homes, there is a real concern that we will not be able to meet the pent-up demand when consumers are ready to get back in the market. This problem threatens to severely slow the housing and economic recovery."

Bank lending standards remain tight and the firestorm created by the issues related to foreclosures could further delay any recovery.

But builder sentiment, which is a good indicator of housing starts and the new home market, is suggesting that demand is stabilizing.

Though still at low levels, the uptick in confidence may be a sign that rock bottom rates are starting to have the desired effect. The next few months should help to confirm if a new trend is developing. Stay tuned.

0 comments:

Post a Comment