The Producer Price Index for September rose 0.4%, the second such monthly increase, as food costs jumped . The core PPI, which excludes food and energy, remained muted, rising 0.1% for the second month in a row.

Year-over-year (y/y), the headline number increased from 3.0% in August to 4.0% in September. The core PPI firmed from 1.3% y/y to 1.5% y/y.

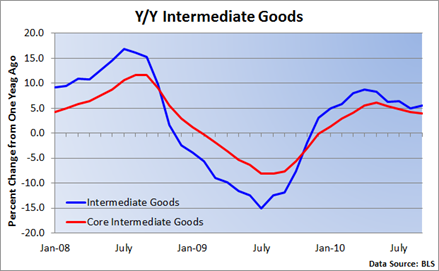

Producer prices are more volatile than consumer prices, but at still considered a top-tier release, as it provides a good look at what’s happening to businesses costs. Unlike core inflation at the retail level, which has held steady at 0.9% for several months, core wholesale inflation has already bottomed and has been ticking higher for about a year (see chart below).

Taking a peak at prices at the earlier stages of production, the indexes below have rebounded nicely, though recent weakness in the U.S. economy has dampened the rate of acceleration (see charts below).

Intermediate goods are defined as intermediate materials, supplies, and components, consisting partly of commodities that have been processed but require further processing.

Examples of such semi-finished goods include flour, cotton yarn, steel mill products, and lumber.

Crude materials are defined as goods that need further processing. These are products entering the market for the first time, have not been manufactured or fabricated and are not sold directly to consumers.

Goods include raw cotton, crude petroleum, coal, hides and skins, and iron and steel scrap.

Both intermediate and core goods are very sensitive to swings in demand, accounting for the sharp drop in prices as world economic activity plummeted. The recovery, which has boosted global demand, has sent prices higher.

However, the jump in costs at the early and middle stages of production are not signaling that a new round of consumer inflation is imminent, in my opinion, as labor costs still makes up the bulk of expenses for most firms. Plus, aggregate demand continues to struggle, making it difficult for all but minor price hikes to stick.

Still, rising prices, which have started to creep into finished goods (see top chart), are indicating that the disinflationary trend in business-to-business sales has ended.

And it goes almost without saying that rising input costs argue heavily against deflation at this point in the global business cycle.

0 comments:

Post a Comment