Lawrence Yun, chief economist for the National Association of Realtors, said, “A housing recovery is taking place but will be choppy at times depending on the duration and impact of a foreclosure moratorium. But the overall direction should be a gradual rising trend in home sales with buyers responding to historically low mortgage interest rates and very favorable affordability conditions.”

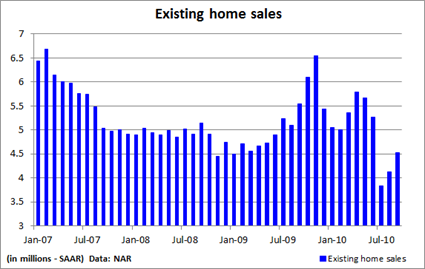

The jump in home sales last month is encouraging and is a sign that the housing market is slowly recovering from the tax-credit induced hangover that pulled sales from the summer and landed them in the spring (graphically demonstrated in the chart above).

But with several false starts behind us, it may be too soon to declare that a recovery is in place, especially since September sales are barely ahead of the lows reached at the end of 2008 and are 19% behind one year ago.

Volatility seems likely to continue as buyers, encouraged by rock bottom interest rates, slowly return to the market, but rates near 4% have not had the anticipated impact that many had anticipated.

Obstacles remain, including high unemployment, elevated jobless claims and the high number foreclosures. And speaking of foreclosures, the affect on housing that may occur from the problems with missing mortgage documents may add to anxieties in an already unsettled market.

On the one hand, the mess could be resolved quickly and lenders that have halted foreclosures might quickly pick back up where they left off. Or long delays could quickly threaten any recovery that may be unfolding. Stay tuned.

0 comments:

Post a Comment