New home sales, defined by the Commerce Department “as a deposit taken or sales agreement signed,” rose 6.6% in September to a seasonally adjusted annual rate of 307,000, beating the Bloomberg estimate of 300,000.

Sales remain 21.5% below one year ago, as the market continues to recover from the dearth in sales that followed the expiration of the tax credit at the end of April.

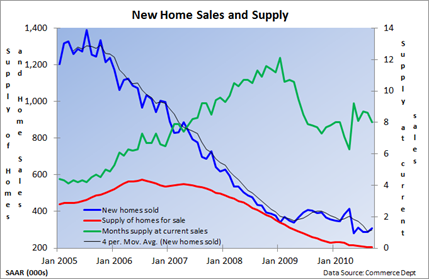

In the meantime, the supply of homes available for sale fell from 206,000 in August to 204,000 in September. Based on actual sales, that translates into a 8.0 month supply, down from 8.6 months.

According the the Commerce Department, it takes four months to establish a new trend, and new home sales do appear to be stabilizing, according to recent data.

Unlike existing home sales, which account for about 90% of all sales, actual inventory that is on the market has come down dramatically over the last four years – see charts – and any decent uptick in activity could quickly eat into supply and bolster new home builders.

However, foreclosures of late model homes remain one of several obstacles that might block the path to a more permanent recovery. Moreover, the repurcussions related to faulty loan documentation have not yet fully played out and could complicate a recovery in housing.

0 comments:

Post a Comment