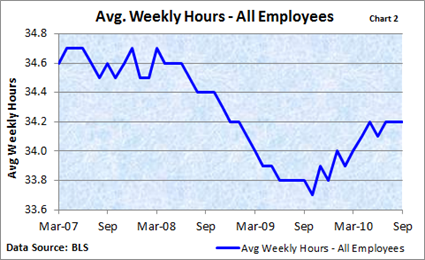

During September, average weekly hours were unchanged at 34.2 hours (see chart 1), and average hourly earnings increased by just one cent to $22.67, rising a scant 1.7% from one year ago (see chart 2).

The decline in average hourly earnings versus the period one year ago has slowed, but the lack of any significant hiring and the large pool of labor available are keeping wage increases in check.

Consequently, minor bumps in salary are hampering growth in consumer spending but is one of several factors helping to keep inflation under wraps.

Average weekly hours normally decline during a recession, just as total employment falls, because companies experience falling profits and declining sales. In other words, firms cut hours because customers spend less money and fewer of them come through the door.

When the economy hits bottom and turns around, companies normally respond by requiring or asking current employees to work longer hours rather than beefing up staff (chart 2 reflects such a scenario).

Why? Because most businesses don’t want to go on a hiring binge and be forced to lay off staff if the economy sinks back into a recession. Only when the recovery enters a more permanent phase does job creation accelerate. Hence, an increase in payrolls lags behind in a recovery.

This time around has been no exception, especially because growth has been lethargic. Add uncertainty into the mix and weak consumer confidence and you have the perfect recipe for a jobless recovery.

0 comments:

Post a Comment