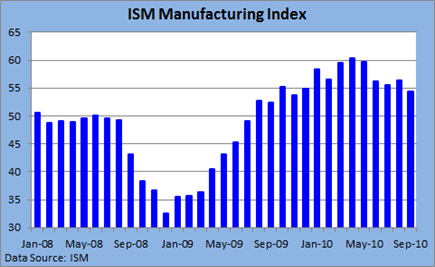

The ISM Manufacturing Index fell from 56.3 in August to 54.4 in September, slightly above most forecasts. The index, which is a national gauge of manufacturing, has been down in three of the past four months, suggesting that activity has been moderating following a sharp rebound earlier in the year. Still, activity continues to move forward at a sustainable level.

A reading of 50 marks the line between expansion and contraction. September marks the 14th consecutive month goods-producers have gained ground following a severe drop in activity two years ago.

Despite the relatively upbeat headline number, a couple of the key components do suggest that activity may continue to recede in the coming months.

New orders slowed from 53.1 to 51.1 and production eased to 56.5 from 59.9. Job growth, like output, has been also been impressive for much of the year. And nonfarm payroll data bear this out.

However, as growth has moderated, employers appear to be cutting back on hiring, with the employment component dipping from 60.4 to 56.5.

Deflation? – not so fast

In the meantime, rising prices at the early stages of production are not consistent with the deflation argument that has gained steam in recent months.

The increase in commodity prices, in part due to a weaker dollar, and stronger demand around the world, helped push prices paid up 9 points to 70.5.

But don’t expect higher costs to be passed along to customers as demand in the U.S. remains tepid, and excess capacity makes it difficult to make prices increases stick.

Additionally, wages and not commodities are the largest input cost for most businesses. Nonetheless, it seems almost inconceivable that retail prices will begin to fall on a broad scale while raw material costs rise.

0 comments:

Post a Comment