Much has been made that the Federal Reserve will eventually announce – probably at the November meeting – that it will once again begin expanding its balance sheet via a series of bond purchases.

Known as

quantitative easing, or QE for short, the bond buys are over and above what are needed to keep short term interest rates at zero, but are necessary, proponents argue, to get the economy moving and put a “deflation firewall” in place.

The Fed announced a very modest program in August, deciding to reinvest any proceeds received from maturing mortgage-backed securities. Fed Chairman Ben Bernanke followed up with a laundry list of monetary tools the Fed still has at its disposal to support growth.

But the

September 21 Fed meeting couldn’t have been clearer:

“The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate.”

Debate at the Fed

Though some at the Fed, like

the Minneapolis Fed chief, have expressed concern regarding how effective new bond purchases may be, others, such as the

president of the New York Fed, were more blunt in their support.

His remark last Friday that “the pursuit of the highest level of employment consistent with price stability, the current situation is

wholly unsatisfactory” is a clear signal that the Fed will announce new measures on November 3, in my view.

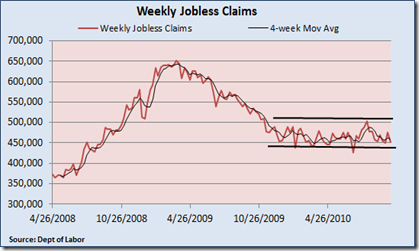

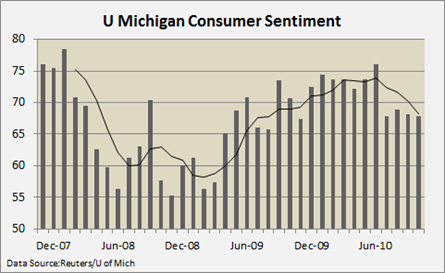

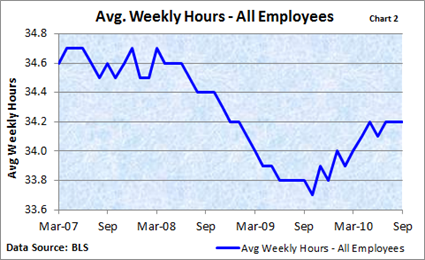

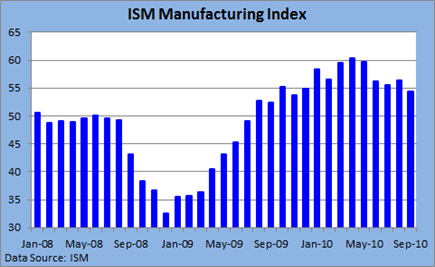

At this point, the Fed would have to be persuaded by robust economic data NOT to pursue bolder options to boost the economy.

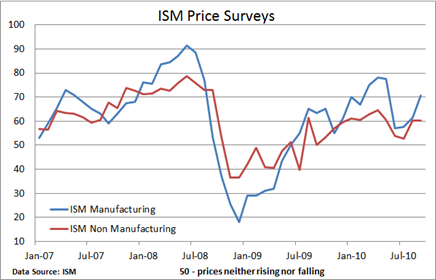

Unexpectedly strong employment, manufacturing or service sector data, combined with an impressive rise in Q3 GDP might persuade the Fed to hold off.

But strong GDP data in itself would not keep policy makers from acting, as an unexpected build in inventory, versus stronger consumer spending, would weigh into the equation.

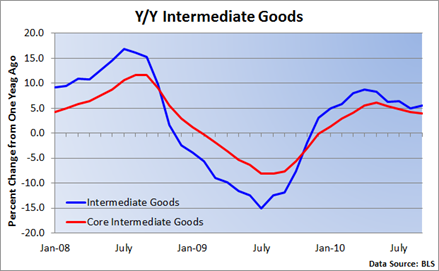

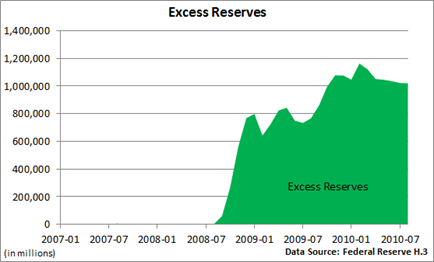

I’ve harped on this before but I believe that a new round of QE would likely have little impact on the economy because

excess bank reserves – funds banks can lend but have not due to tight lending standards and lack of consumer interest – already stand at $1 trillion!

Any new purchases would most likely end up increasing these excess reserves, which would end up being held at the Fed. And it could fuel a slide in the dollar and boost commodity inflation and speculative excess in emerging markets.

Falling Treasury yields

So far, the yield on the ten-year Treasury has fallen from a 2010 peak of just under 4% in April to nearly 2.4% in August, where it is currently hovering.

The debt crisis in Greece initially pressured yields, but as the crisis faded, rates continued to descend amid weak economic data and falling inflation expectations.

Speculation that the Fed might ramp up bond purchases also played a role, but it is difficult to quantify how much the drop in yields can be attributed to QE talk versus slower growth.

The Fed has total control over the fed funds rate, but its influence over longer-term rates is more limited, which limits the effectiveness of QE.

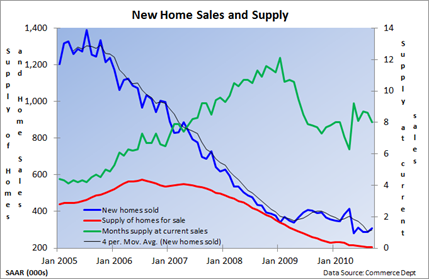

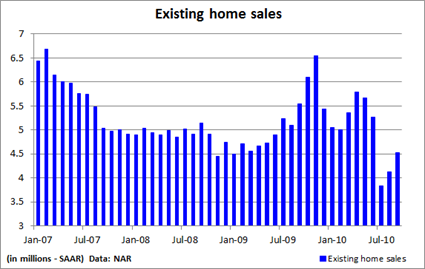

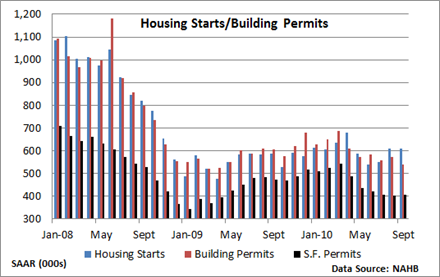

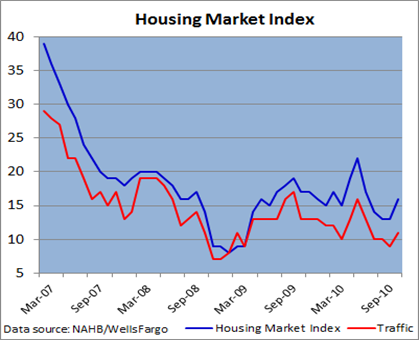

Although mortgage rates are at record lows, the housing market has struggled. Rates below 4% could provide minor support, but at this point, monetary policy has lost most of its punch, suggesting we are in or are near a liquidity trap.

With fiscal policy being held captive by a large federal deficit, time may be the only option left to fix what ails the economy.